By Kylie Garcia

The Santa Fe New Mexican

(TNS)

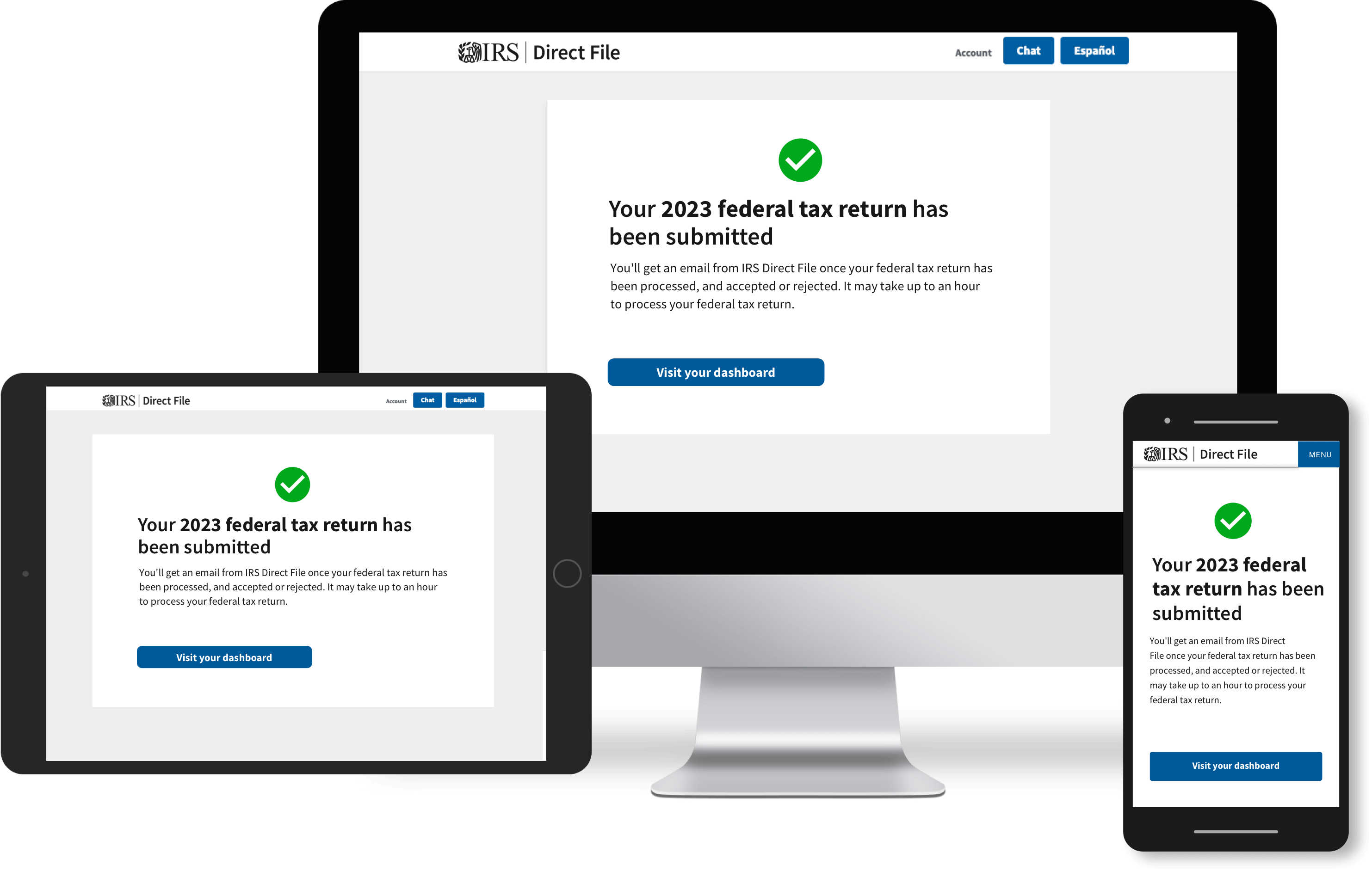

Aug. 5—New Mexico is now the fourth state that can use the IRS’s new system for filing federal taxes, which officials believe will make the 2025 tax season easier and save people time and money.

After conducting successful pilots in 12 states last year, the U.S. Treasury Department and the IRS announced the Direct File system as a permanent option in May and invited all 50 states to jump on board. Oregon, New Jersey and Pennsylvania were the first to accept, with New Mexico following suit at the beginning of this month.

According to a news release from the Treasury Department, the pilot program “saw 140,000 taxpayers claim more than $90 million in refunds and save an estimated $5.6 million in filing costs using the new free online filing tool.”

According to a Taxypayer Burden Survey, the average American spends $270 and 13 hours filing taxes. The new filing system is supposed to alleviate those financial and time burdens.

Gov. Michelle Lujan Grisham, U.S. Sen. Martin Heinrich and U.S. Rep. Melanie Stansbury hailed the new tool, but local tax preparation services offered mixed reviews.

“It’s great for people that need to file a very simple tax return,” said Albuquerque’s Tax Busters owner Erika Love Major.

“So we have people calling us and asking us questions … it’s a great idea, but at the same time, there’s a huge gap, and then it puts more burden on us [private tax preparation services]. It adds a level of work for me, where that is what I do for a living,” Major said.

“I don’t know if it’s good or bad in the net result,” said Tax Help Santa Fe owner Peter Doniger.

Doniger said his only concerns for individuals filing themselves is their use of the Direct File system for federal taxes, but improperly filing their state taxes, which can be done for free though a state system called Taxpayer Access Point. He noted many New Mexicans don’t use that system.

State Taxation and Revenue Department spokesman Charlie Moore said officials try to raise awareness about the TAP system, particularly as tax season approaches.

“It’s a matter of getting the word out every year,” Moore said.

Moore said IRS Direct File will make filing for both federal and state easier in New Mexico. Prior to Direct File, individuals filing for themselves would have to file their federal taxes first and then reenter all of the federal information when filing for state.

“We don’t know exactly how it’s going to work, but you should be able to import, now, some of that data from the federal return. So it should make using our version of Direct File easier to use,” Moore explained.

Moore noted the new system is designed for people “with simpler returns,” adding those with more complex tax situations may want the help of a professional.

_______

(c)2024 The Santa Fe New Mexican (Santa Fe, N.M.). Visit The Santa Fe New Mexican (Santa Fe, N.M.) at www.santafenewmexican.com. Distributed by Tribune Content Agency LLC.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs